- #INTUIT QUICKBOOKS PRO WITH PAYROLL 2017 PRO#

- #INTUIT QUICKBOOKS PRO WITH PAYROLL 2017 SOFTWARE#

- #INTUIT QUICKBOOKS PRO WITH PAYROLL 2017 PROFESSIONAL#

The system will alert you when creating an invoice if there are any outstanding time or expenses for that customer. The QuickBooks Time Tracking functionality allows you to properly track your employees’ time to avoid under-billing your customers. Meaning when you enter inventory items, the correct corresponding PO is automatically reconciled. Upon receiving the inventory, QuickBooks recognizes the products and matches it to the appropriate PO. All you need to do is select the appropriate vendor from a list of vendors and select an inventory item to order.

#INTUIT QUICKBOOKS PRO WITH PAYROLL 2017 PRO#

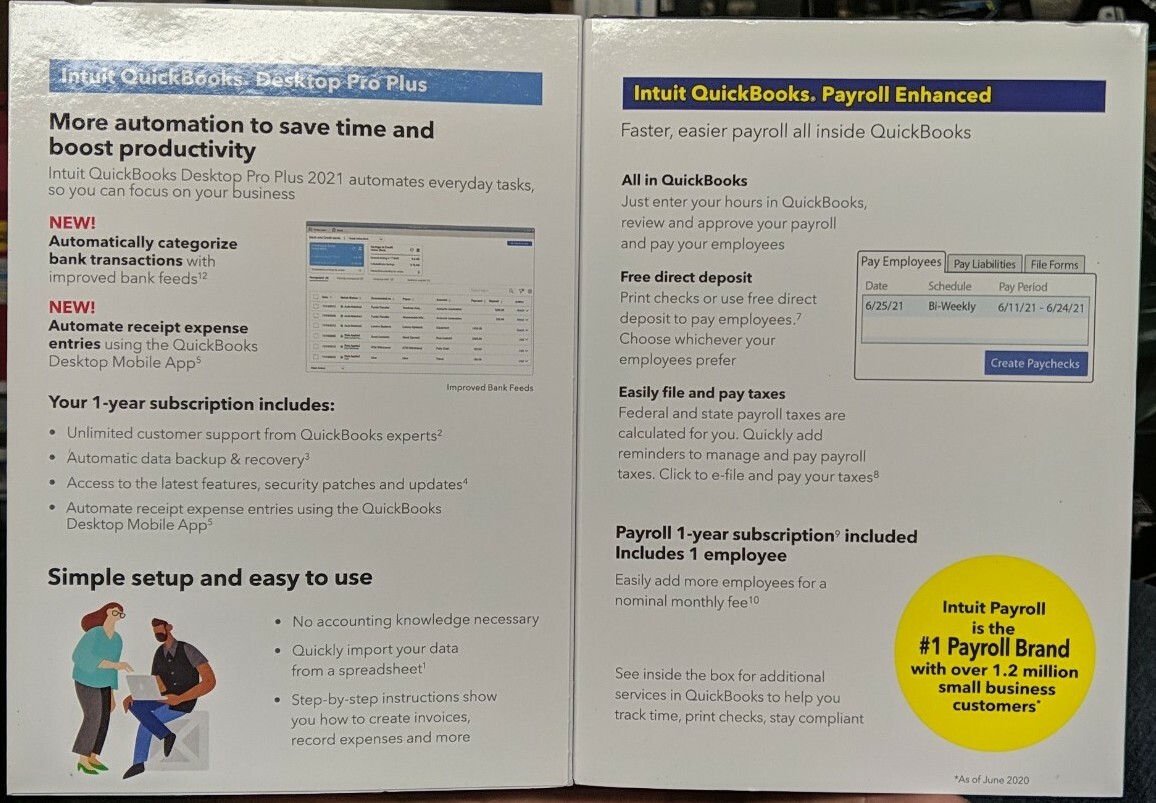

QuickBooks Pro gives you the ability to create purchase orders for your purchases. QuickBooks Pro contains every tool you need to pay your employees. You can have the system automatically populate and print 1099s for independent contractors.

#INTUIT QUICKBOOKS PRO WITH PAYROLL 2017 SOFTWARE#

The software is capable of paying employees by direct deposit as well. The system will allow you to process payroll with appropriate tax deductions. The payroll application will allow you to manage your staff. The system will allow you to setup reorder points that will automatically alert you as to when you should reorder a product. This will allow you to avoid overbuying and backorders. QuickBooks Pro gives you the ability to track your inventory. This allows you to later refer back to the budget to see how your actual spending compares to your original budget. The budgeted amounts are then fully adjustable either individually or across line items. Using recent spending history, the system will allow you to create a working budget automatically.

Any report in the system can be exported to Microsoft Excel. Within each report you can click on any number to see the details behind it. Each report is adjustable, allowing you to gain useful insight into your business. QuickBooks Pro uses the transactional history established in the general ledger to provide you with over 100+ pre-designed reports. It will provide you with a consolidated view of who owes you money, who you owe money to, important reminders, and income/expense performance. The General ledger will allow you to stay on top of your business. Invoices can be created from over 100 pre-designed templates you can even customize invoices to show your company logo and tag line. customer contact info & products/services) to create invoices in a snap. Using the data that has already been entered in QuickBooks (i.e. QuickBooks Pro allows you to create invoices and track receivables. Using QuickBooks Merchant Services you can even accept customer credit card payments directly right in QuickBooks. This allows you to track and follow up on past-due accounts and answer all customer requests more efficiently. QuickBooks Pro gives you the ability to create a central data repository, containing all customer contact and transactional data. To ensure that you don’t incur costly late fees, QuickBooks has a reminder feature that will allow you to record bills as they come and set a reminder to pay them before they are due. QuickBooks will help ensure that all of your financial obligations are met on time. By using a batch processing method you can print all of your checks at once, and have them tracked for ultimate control of your money. The system will also allow you to create and print checks. Plus, QuickBooks helps you fill out your sales tax form in minutes and make sure your sales tax balance is accurate and up-to-date. QuickBooks helps you keep track of expenses, so you can see the money you’re spending in each category. TurboTax & TurboTax for Business Integration.Quicken & Quicken Home and Business Conversion.

#INTUIT QUICKBOOKS PRO WITH PAYROLL 2017 PROFESSIONAL#

QuickBooks, with more than 80% retail market share and over 2 million users, is the undisputed leader in accounting software for small businesses.

0 kommentar(er)

0 kommentar(er)